Description

About the Event

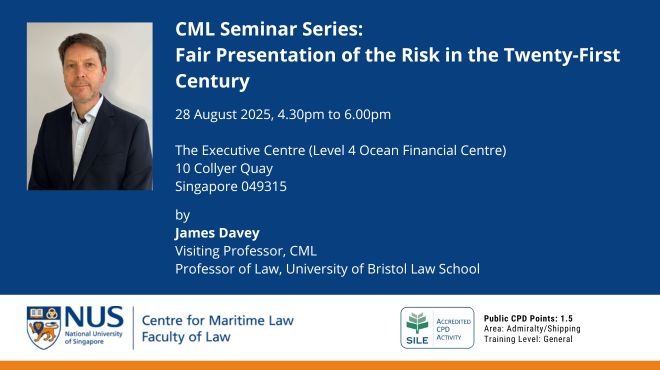

One of the defining duties of the marine insurance relationship is the burden on the insured to provide the underwriter with sufficient information before the contract is made, for the risk to be assessed and priced. The statutory changes made in English law through the Insurance Act 2015 have been recommended for incorporation into Singaporean law. Some of these changes are legally significant. However, equally important changes can be tracked through the case law. What both trends have in common is a move towards the ‘fair presentation of the risk’ as a shared and dynamic task, involving the active participation of underwriter, broker and insured. This is in stark contrast to the apparent position in the former regime in the Marine Insurance Act 1906.

This talk will review the statutory changes in English law, and especially to the remedy, as English law begins to give shape to the ‘proportional regime’ in the Insurance Act 2015. It will also reflect on the ‘reactive’ nature of both materiality and inducement, as considered in recent litigation, and especially in Delos Shipholding v Allianz Global SE, The Win Win [2024] EWHC 719 (Comm).

About the Speaker

James Davey is Professor of Insurance & Commercial Law at the University of Bristol and Visiting Professor at the National University of Singapore. He is currently Chairman of the British Insurance Law Association. He has taught and researched insurance law for more than thirty years and is co-author of Miller’s Marine War Risks, the leading practitioner guide to the insurance of political risks in marine markets. His research has been relied on in argument before the UK Supreme Court, and he has been actively involved in shaping doctrinal and regulatory policy in his field throughout his career. He acted a research consultant for litigators involved in arbitration across several jurisdictions, and in litigation before the English High Court, Court of Appeal and Supreme Court, including the COVID-19 Test Case. His research draws upon doctrinal, economic and sociological perspectives of insurance. He is currently on research leave, working towards the first sustained study of the intersection between insurance law and discrimination law.

TERMS AND CONDITIONS

1. Fees are to be paid before the commencement of the event with exception of e-invoices (if applicable).

2. Fees paid are non-refundable (if applicable).

3. Registration is transferable within the same organisation if the request is made at least one week before the event.

4. By filling up this Registration Form,

i. Participants agree and consent that their personal data provided in this form may be collected, used, processed, and disclosed by NUS and the event organisers for the purposes of processing their registration, in accordance with the Personal Data Protection Act 2012 and all subsidiary legislation related thereto.

In respect to disclosure, NUS may disclose participants personal data to thirdparties (which may be in or outside of Singapore) where necessary for such purposes.

ii. Participants will also consent to NUS taking photographs and videos for the purposes of event reporting, marketing, publicity, and media/social media. Participants further consent to NUS disclosing such photographs and videos to third party media entities (whether in Singapore or otherwise) for publicity purposes, and NUS may identify them by name.

iii. NUS and designated event organisers reserve the right to alter any of the programme or other arrangements for this event, including cancellation or postponement of the event, should circumstances so warrant.

Date and Time

Thursday, 28th August 2025 4:30PM GMT+08:00

to

Thursday, 28th August 2025 6:00PM GMT+08:00

Organisation

Faculty of Law

Contact Email

cml@nus.edu.sg

Location

The Executive Centre | Level 4 Ocean Financial Centre, 10 Collyer Quay, Singapore 049315